24+ Paying extra on mortgage

There are many ways to make an extra mortgage payment. How many years can I reduce my mortgage by paying extra.

Mortgage Payment Coloring Printable Tracker 30 Year Journal Etsy Mortgage Payment 30 Year Mortgage Mortgage

Paying additional principal on your mortgage can save you thousands of dollars in interest and help you build equity faster.

. How Much Interest Can You Save By Increasing Your Mortgage Payment. For example if you have a 30-year 250000 mortgage with a 5 percent interest rate you. Simply by making an additional payment over the life of a 15-year mortgage for 300000 dollars at an.

Here are the most popular ways. The amount saved will vary based on the initial size of the loan and interest rate. Paying an extra 1000 per month would save a homeowner a staggering 320000 in interest and nearly cut the mortgage term in half.

Ways to Make an Extra Mortgage Payment. House was 160k at purchase probably can. If you can up your payments by 250 the.

Adding an Extra Mortgage Payment of 10 Per Month Even adding a nominal amount such as 5 or 10 On a monthly basis over a long period of time Can save you. Just paying an extra 50 per month will shave 2 years and 7 months off the loan and will save you over 12000 in the long run. Monthly payments around 850 principal interest taxes to escrow.

Pay an Extra 100 a Month. Even paying 20 or 50 extra each month can help you to pay down your mortgage faster. 96k remaining on a 125k loan at 375 we made some extra payments.

Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Conforming fixed-rate estimated monthly. Adding Extra Each Month Just paying an additional 100 per month towards the principal of the mortgage.

Our mortgage payoff calculator can show you how making an extra house payment every quarter will get your mortgage paid off 11 years early and save you more than. Making an extra mortgage payment each year Adding extra dollars to every payment Applying a lump sum to your payment such as with your tax return The benefit of. Home financial.

However if this same homeowner were to make one extra mortgage payment every year the borrower will have paid off the loan in 26 years versus 30 years. Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. There are several ways to prepay a mortgage.

Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments. To be more precise itd shave nearly 12.

Debt To Income Ratio Advance America

Refinance A Loan Advance America

Extra Payment Mortgage Calculator Mortgage Payment Calculator Amortization Schedule Mortgage Calculator

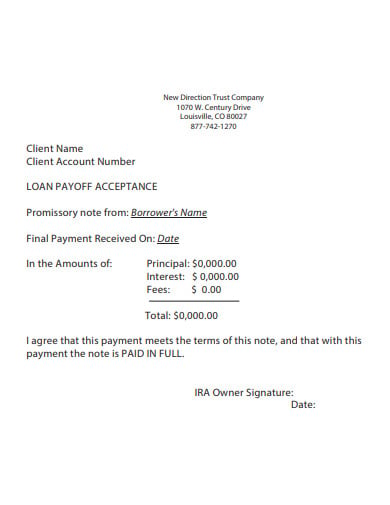

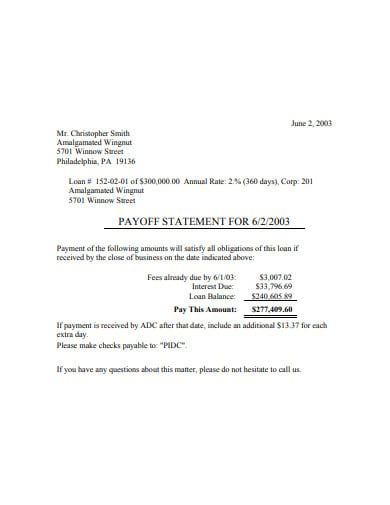

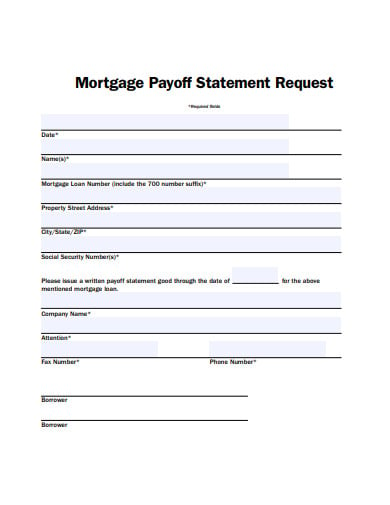

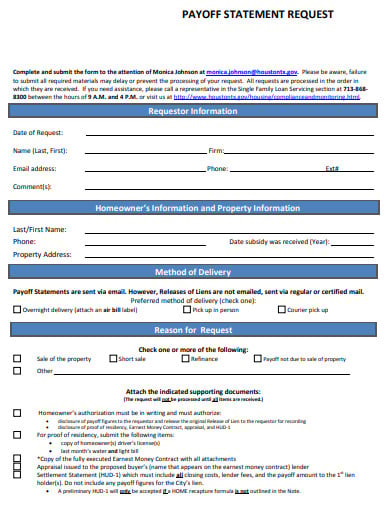

13 Payoff Statement Templates In Pdf Free Premium Templates

13 Amazing Amortization Schedule Templates In Excel Find Word Templates

Chris Menard Cmenardvpbmo Twitter

Payment Reminder Email How To Write 24 Samples

13 Payoff Statement Templates In Pdf Free Premium Templates

What Is Financial Literacy Advance America

13 Payoff Statement Templates In Pdf Free Premium Templates

The Best Mortgage Calculator With Extra Payments Mortgage Calculator Mortgage Tips Mortgage

Should I Pay Off My Loan Early Advance America

Free 15 Loan Schedule Samples In Ms Word Ms Excel Pages Numbers Google Docs Google Sheets Pdf

Download Our Free Mortgage Payment Calculator With Extra Principal Payment Excel Template Input Only Fe Mortgage Payoff Free Mortgage Calculator Loan Payoff

How To Get Out Of Debt Pay Off Debt Or Save Advance America

13 Payoff Statement Templates In Pdf Free Premium Templates

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff