28+ Online mortgage pre approval

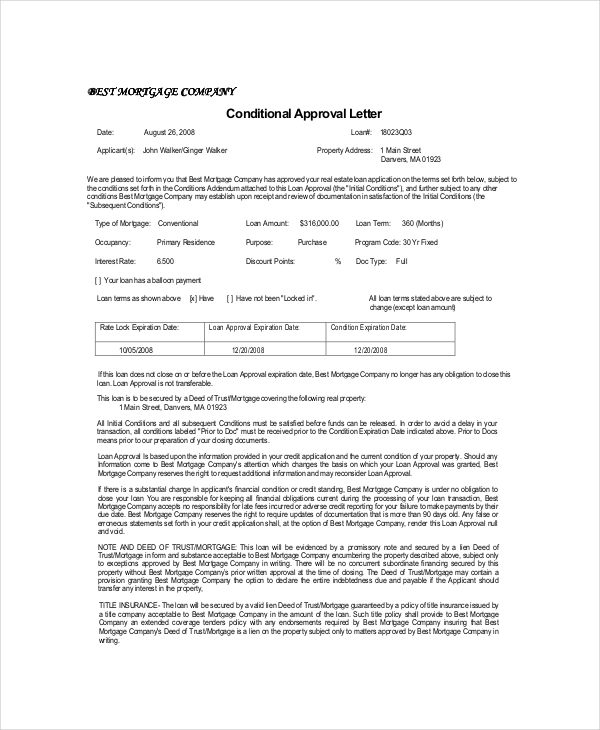

Its important to note that pre-approval is very different from pre-qualification in that pre-approval requires a much more thorough investigation and. Both prequalification and preapproval provide borrowers with an estimation of how much home they can afford.

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Contact a mortgage loan officer to learn more about these important pieces of the homebuying journey.

. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Best Companies of 2022. However a mortgage preapproval is a more official step that requires the lender to verify your financial information and credit history.

A seller often wants to see a mortgage pre-approval letter and in some cases proof of funds to show that a buyer is serious. Money Management Capital Ones Credit Policies. Mortgage rate trends in the 1970s.

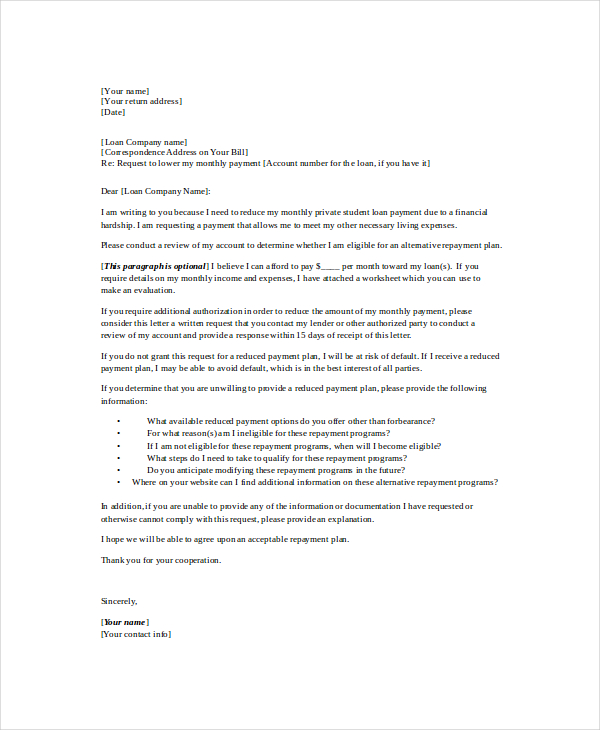

Mortgage-pre-qualifying and pre-approval may seem like similar procedures. By going through the pre-approval process youll know exactly what you can afford before going house hunting. An approval letter can be defined as an official document that is written in response to the approval requests placed by you.

Fund whats next for your business and apply online. Rates program terms and conditions vary by state and are subject to change without notice. Gold Coast Schools is an approved provider of the required Mortgage Loan Originator Courses.

NMLS 93184. Homeowners insurance and property taxes. As of 2017 Canada has seen a move towards mobile and online technology in the mortgage industry.

Factors that impact affordability. Our loan officers are located across 28 states and can assist you with whatever your dream may be including buying. This pre qualification calculator estimates the minimum required income for a house will let you know how much housing you qualify for a given income level.

Apply online or speak with an expert loan officer today. Typically lenders cap the mortgage at 28 percent of your monthly income. They then take that number and add in all your monthly debts like car loan payments monthly credit-card minimums.

July 27 2021 1 min video. Get free mortgage loan pre-qualification within hours. A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

You can find this by multiplying your income by 28 then dividing that by 100. These approval letters represent a written request for any certain request. Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000.

Keep in mind that closing costs including any additional taxes and fees can add up. The Speedpay link to pay your. Arah S Jun 28 2022 Stacy Hooper.

Article February 13 2020 6 min read. Biz2Credit helps entrepreneurs to get financing and small business loans with a fast approval process. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

When it comes to calculating affordability your income debts and down payment are primary factors. That figure should be no more than 28 of your gross monthly income. Many financial advisors have suggested adhering to the 2836 rule which says to not spend more than 28 of your gross monthly income on housing expenses and only 36 of your.

How a LendingTree Mortgage Works. A Legacy home mortgage specialist can perform a pre-qualification or pre-approval so that youll have a good idea of how much you can afford. It could be mortgage approval graduate credit approval leave approval etc.

However factoring in the 36 percent rule the borrower would also only have room to. Online mortgage lending in Canada. Once youre pre-qualified youll know exactly how much you can borrow even before you find a home.

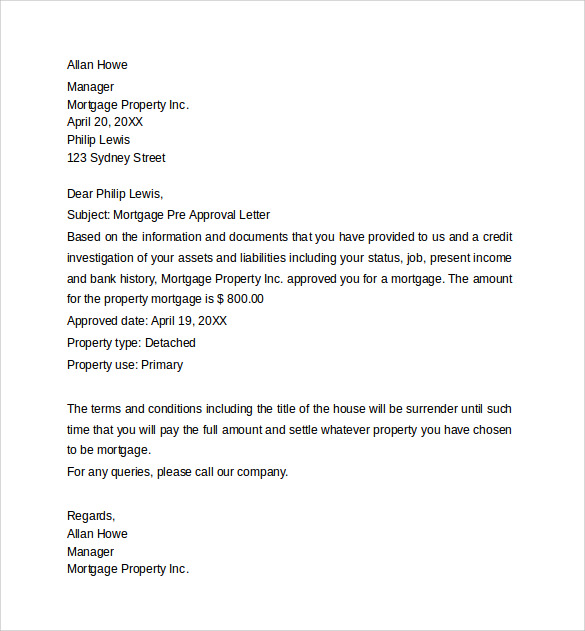

Some people may even use these terms interchangeably which make it confusing for buyers. To determine your front-end ratio multiply your annual income by 0. Mortgage pre-approval letters are typically valid for 60 to 90 days.

Understanding the differences between pre-approval and pre-qualification and how they may affect credit scores. Applying for a lenders agreement in principle pre-approval gathering all needed documents paystubspayslips bank statements etc. Going by the 28 percent rule the borrower should be able to reasonably afford a 1400 mortgage payment.

CIBC has created a mobile app that is presently in beta testing. Legacy Mortgage is a member of the Eustis Family of Companies which allows us to focus on our customer with a strong history of helping homeowners. Why should I get pre-approved for a mortgage.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1078 monthly payment. Pre-approval has a greater impact on your ability to close a deal compared to pre-qualification. Get answers to some basic home affordability questions.

Explore other calculators for specific mortgage loan types. Assurance Financial offers cutting-edge 15 minute online mortgage applications. Overall the annual average 30-year mortgage rate has trended downward since 1972 according to data from Freddie Macs Primary Mortgage Market Survey.

However these are two entirely different processes. July 28 2022 6 min read. 30-year fixed loans.

1 All loans are subject to credit review and approval. Documents required for a preapproval may include pay stubs tax returns and even your Social Security card. How to Get Pre-approved for a Mortgage.

While your personal savings goals or spending habits can impact your. Get approval on a specific property once you have found the home you want to buy or. Approval letters certify that a certain request has been approved.

Successfully complete the 20-hour FL SAFE Comprehensive course classroom approval 12068 classroom equivalent approval 12023 online approval s 7944 and 10970 Students can not miss any hours of this course for any reason as per NMLS requirements.

How To Get Pre Approved For A House Quora

When And Why Should I Get Pre Approved For A Mortgage Preapproved Mortgage Mortgage Refinance Mortgage

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Same Day Mortgage Pre Approval Online With Competitive Mortgage Rates Preapproved Mortgage Business Ideas For Beginners Mortgage

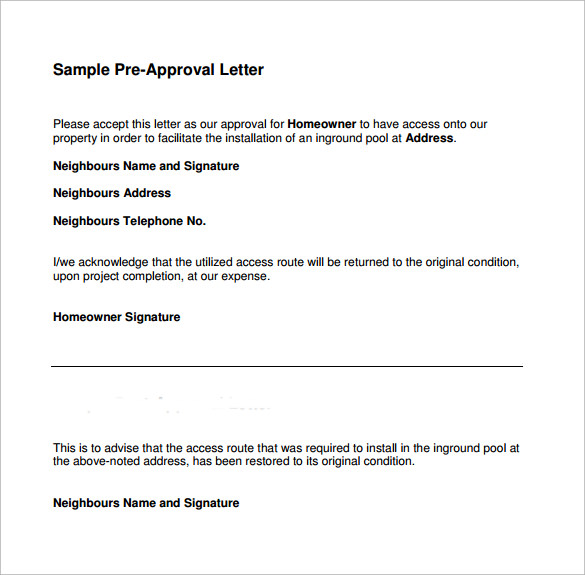

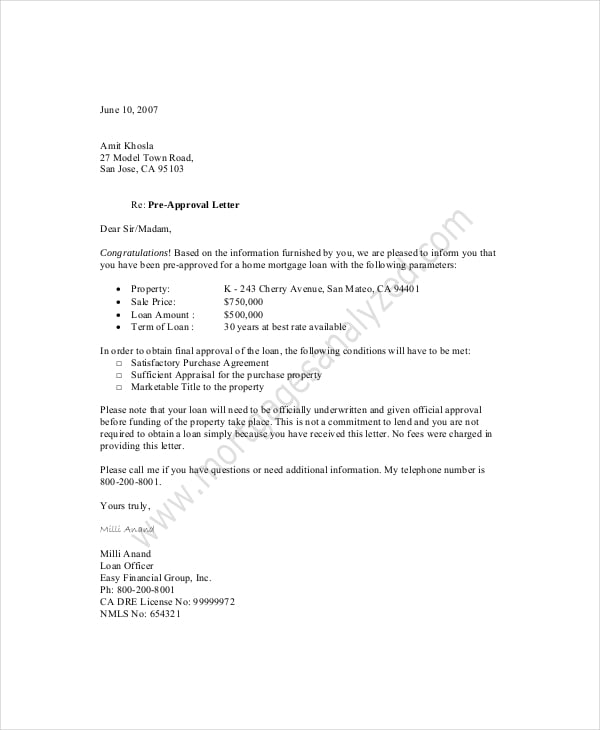

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs Free Premium Templates

Mortgage Pre Approval Letter How To Write A Mortgage Pre Approval Letter Download This Mortgage Pre Approval Letter Preapproved Mortgage Lettering Mortgage

Free 7 Sample Pre Approval Letter Templates In Ms Word Pdf