Percentage of federal taxes taken out of paycheck

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Determine if state income tax and other state and local taxes.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The federal withholding tax has seven rates for 2021.

. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. What is the percentage that is taken out of a paycheck. What percentage of federal taxes is taken out of paycheck for 2020.

The wage bracket method uses a chart to determine your income tax. The amount of federal income tax. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

This is because all. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck. For a single filer the first 9875 you earn is taxed at 10.

The Social Security tax is 62 percent of your total pay. The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. The federal income tax has seven tax rates for 2020.

Exactly how much your employer. The good news is. 10 12 22 24 32 35 and 37.

Also What is the percentage of federal taxes taken out of a paycheck 2021. Since 142800 divided by 6885 is 207 this threshold is reached after the 21st paycheck. Your 2021 Tax Bracket To See Whats Been Adjusted.

How Your Louisiana Paycheck Works. You owe tax at a progressive rate depending on how much you earn. What percentage of taxes are taken out of payroll.

The employer portion is 15 percent and the. For a single person making between 9325 and 37950 its 15. To determine what percentage of federal taxes is withheld from your paycheck you must use the percentage.

10 percent 12 percent 22 percent 24 percent 32 percent 35. There are seven federal tax brackets for the 2021 tax year. The federal withholding tax.

Ad Compare Your 2022 Tax Bracket vs. These are the rates for. Federal Paycheck Quick Facts.

Calculate Federal Insurance Contribution Act taxes using the latest rates for Medicare and Social Security. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Do this later.

The only way you can get around this is if your income is very low. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Paycheck Tax Calculator.

Elected State Percentage. The federal income tax has seven tax rates for 2020. Next up is federal income tax withholding.

For instance the first 9525 you earn each year will be taxed at a 10 federal rate. Your bracket depends on your taxable income and filing status. For the first 20 pay periods therefore the total FICA tax withholding is equal to or.

There is no universal federal income tax percentage that is applied to everyone. Federal income taxes are paid in tiers. Discover Helpful Information And Resources On Taxes From AARP.

What Is the Percentage of Federal Taxes Taken out of a Paycheck. 10 12 22 24 32 35 and 37. Federal income tax rates range from 10 up to a top.

A single person making between 0 and 9325 the tax rate is 10 of taxable income. What percentage of my paycheck is withheld for federal tax 2021. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

The current rate for. You pay the tax on only the first 147000 of.

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

2022 Federal State Payroll Tax Rates For Employers

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

How To Calculate 2019 Federal Income Withhold Manually

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Federal Income Tax Fit Payroll Tax Calculation Youtube

Irs New Tax Withholding Tables

How To Calculate Federal Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Taxes Federal State Local Withholding H R Block

Income Taxes What You Need To Know The New York Times

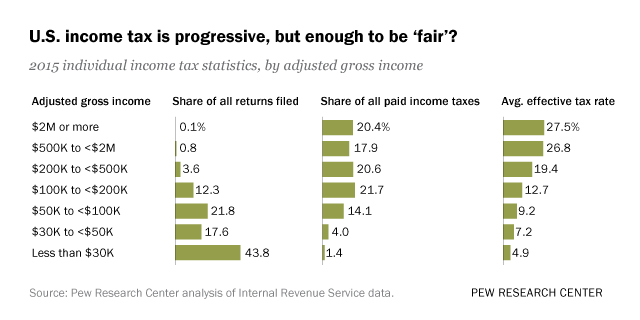

Who Pays U S Income Tax And How Much Pew Research Center

Which States Pay The Most Federal Taxes Moneyrates